Contents

The Biden-Harris Administration has passed a crucial initiative to assist developers in converting emptying commercial buildings into much-needed housing in business and financial districts.

Cities that have already taken action to undergo this transformation, like Minneapolis and San Francisco, have already reported positive results in the form of revived economies and more available affordable housing.

The most considerable component of Biden’s initiative is the various funding options made available to help offset some of the costs of these conversions. These funding options can be stacked for optimum savings.

Let’s dissect which options we think are going to be the most beneficial for your conversion project.

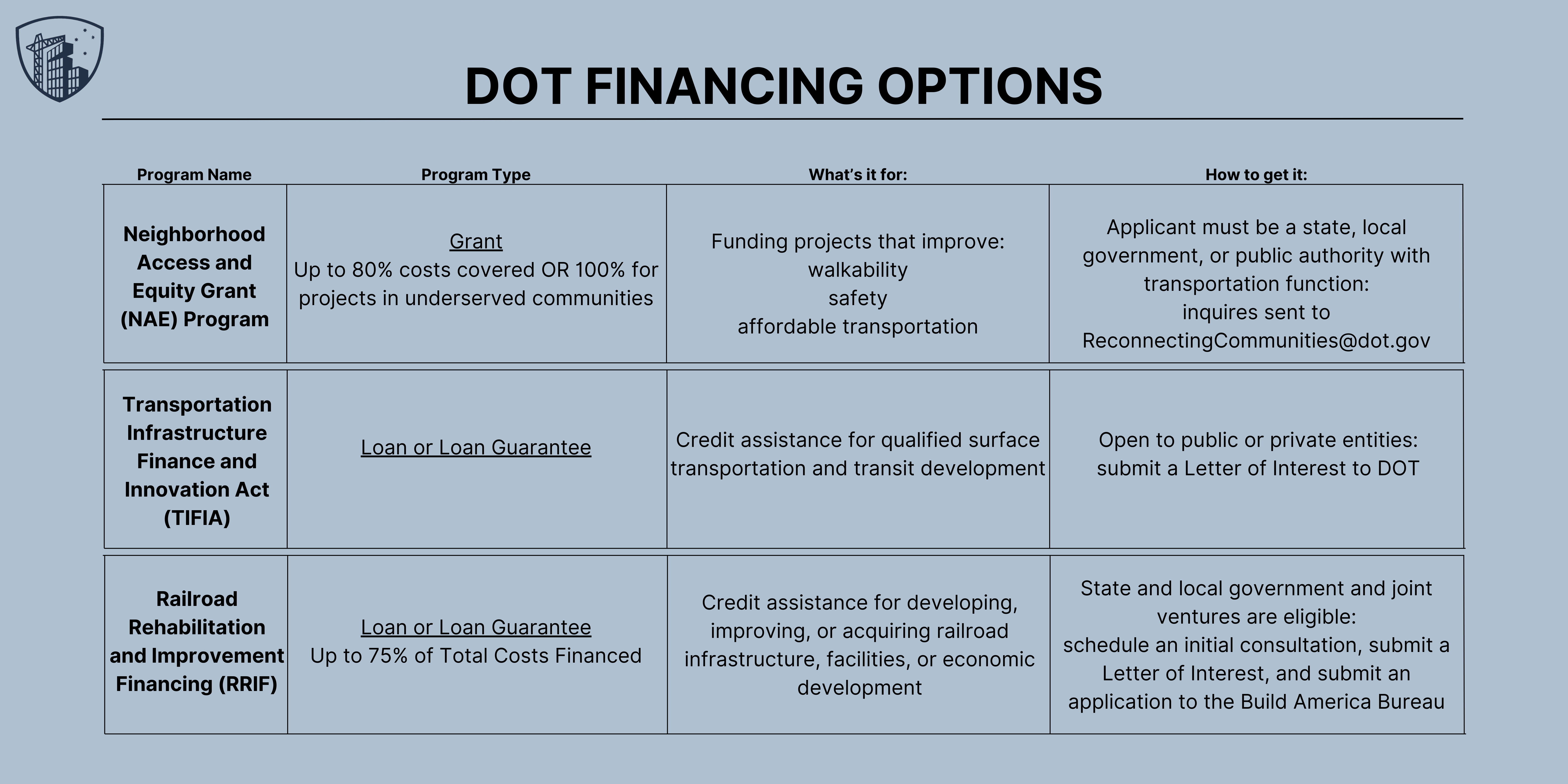

Department of Transportation (DOT) Financing Options

Killing two birds with one stone, the Department of Transportation (DOT) is jumping on the bandwagon to encourage housing closer to public transportation.

Financial and business districts are notorious for having excellent public transportation in the form of bus stops and subway stations, especially in bustling cities like San Francisco and Boston.

With $35 billion in funding, the DOT has assembled the following financing incentives.

Neighborhood Access and Equity Grant (NAE) Program

Program Type: Grant, Up to 80% costs covered, or 100% for projects in underserved communities

What’s it for: Funding for projects that improve walkability, safety, and affordable transportation access, especially in disadvantaged communities. The program also supports planning, capacity building, and technical assistance to streamline project delivery and enhance the capability of local governments in delivering surface transportation projects.

The NAE program can provide funding to support changes in land use through transportation planning and infrastructure.

How to get it: Lead applicant must be a state, unit of local government, or other public authority with a transportation function.

Questions and inquiries can be sent to ReconnectingCommunities@dot.gov

Transportation Infrastructure Finance and Innovation Act (TIFIA)

Program Type: loan or loan guarantee

What’s it for: Program provides credit assistance for qualified surface transportation and transit-oriented development.

In terms of converting commercial buildings to residential homes, TIFIA is available for vertical construction of buildings owned or utilized by the public sector, as well as those open to the public and supporting public services or purposes. This includes projects enhancing residential housing within proximity to fixed guideway transit facilities or intermodal facilities, and TIFIA can also finance economic development.

The loan can be used for the following costs:

- Development phase activities, such as planning, feasibility studies, environmental reviews, etc

- Construction, reconstruction, rehabilitation, and acquisition of property

- Capitalized interest necessary to meet market requirements

How to get it:

TIFIA is open to public or private entities.

Submit a Letter of Interest to DOT to be considered.

Railroad Rehabilitation & Improvement Financing (RRIF)

Program Type: loan or loan guarantee, up to 75% of total costs can be financed by this program

What’s it for: provides credit assistance through direct loan and loan guarantees for developing, improving, or acquiring railroad infrastructure or facilities, and economic development, which is where our commercial building conversions come into the picture.

To qualify, your project must meet the following requirements:

- Incorporates private investment of at least 20% of the total project cost

- Project is physically connected to, or is within half a mile from public transit

- Show proof that contracting for construction begins within 90 days after approval of the loan

- Show proof that the project will generate sufficient additional revenue for the related public transit system

How to get it:

State and local governments and joint ventures are eligible for this program.

These entities can schedule an initial consultation, submit a Letter of Interest, and submit an application to the Build America Bureau to be considered.

In the initial consultation, you will be asked to share:

- Description of the project, and estimated benefits of the project

- How the project will enhance safety, environment, economic development, etc

- Description of collateral to be offered as security and its value

- Audited financial statements of the last five years

- Projected revenue for the next five years

- Potential environmental impact of the project

For more details about the requirements, you can visit the Build America Bureau.

Department of Housing and Urban Development (HUD) Financing Options

The Department of Housing and Urban Development (HUD) is a U.S. government agency dedicated to addressing housing needs and promoting sustainable urban development.

HUD implements various programs and initiatives to promote access to safe and affordable housing, and that includes office building conversions.

HUD has passed multiple options for assisting with these types of projects, but there are the two we find to be the most beneficial.

.png?width=7222&height=2763&name=DOT%20%20Financing%20Options%20(1).png)

Mortgage Insurance for Rental Housing for Urban Renewal and Concentrated Development Areas

Program Type: loan guarantee, up to 90% of the estimated repair costs and estimated value of the property.

Interest rates will be fixed based on market rates.

What’s it for:

This program is applicable for financing commercial to residential conversions that necessitate significant rehabilitation, particularly when replacing two or more major building components or when the repair costs surpass specific thresholds.

Properties must consist of five or more units and must be located in an urban renewal area or area receiving rehabilitation assistance as a result of a natural disaster. Commercial space cannot exceed 25% of the total rentable area of the building and commercial income cannot exceed 30% of the gross projected income.

How to get it:

This program is open to private entities, public bodies, and others who meet HUD mortgage requirements.

You must work with a Multi-Family Accelerated Processing (MAP) approved lender who will submit the documented requirements to HUD for a pre-review.

If everything is in the clear, HUD may ask the lender to submit a formal application.

This involves a detailed review of the project, considering things like if the area needs more housing, if the design is sufficient, if the borrower demonstrates capacity and capability for the loan, and if community resources are available. If the project meets all the requirements, the HUD region gives the green light, committing to insure the mortgage for the lender.

Low-Income Housing Tax Credit

Program type:

Tax credit

Who’s it for:

The Low-Income Tax Credit is an initiative provided for states and local governments to increase the supply of affordable housing, and commercial building conversions fall into this bucket.

How to get it:

State and local governments can apply and allocate the federal tax credits to interested developers. Developers must prove that their projects will satisfy their state’s housing needs. Contact your local city officials to inquire about available tax credits and what documents are needed to qualify.

Living units must be affordable for people earning no more than 60% of the median income of the area. The property must remain affordable for at least 30-years.

Department of the Treasury (UST) Financing Options:

The Department of Treasury (UST) is making a focus on energy efficiency, especially in residential structures. UST sees these conversions as an opportunity to update these structures to meet EPA’s Energy Star certification requirements and make improvements to heating, cooling, water, and building envelope.

.png?width=6962&height=1860&name=DOT%20%20Financing%20Options%20(2).png)

New Energy Efficient Home Credit

Program type:

Tax credit

Who’s it for:

This program is ideal for commercial to residential conversions that participate in the Energy Star Multi-Family New Construction Program.

The tax credit is given to the "eligible contractor," which is the person or company that converted the building and owned it during the process. For instance, the developer hires a third-party contractor to convert the building to residential homes, the person who hired them is the eligible contractor, not the third-party contractor. To qualify for the tax credit, the eligible contractor must sell or lease the new units for residential use.

How to get it:

Your finished conversions will need to meet Energy Star home program requirements or DOE Zero Energy Ready Home (ZERH) requirements.

Once completed, you will need to have the energy efficiency of the renovation certified by a DOE ZERH Builder of Verified Partner.

You can view the list of verified partners here.

Next Steps to Converting Your Office Building

Unlock a future of possibilities with VBC. Our comprehensive resources, deep industry knowledge, and extensive experience make us the ideal partner to transform your office building into affordable housing.

Discover the potential within your property and join us in building communities. Contact VBC today to initiate the transformation.